FAQs

What am I investing in?

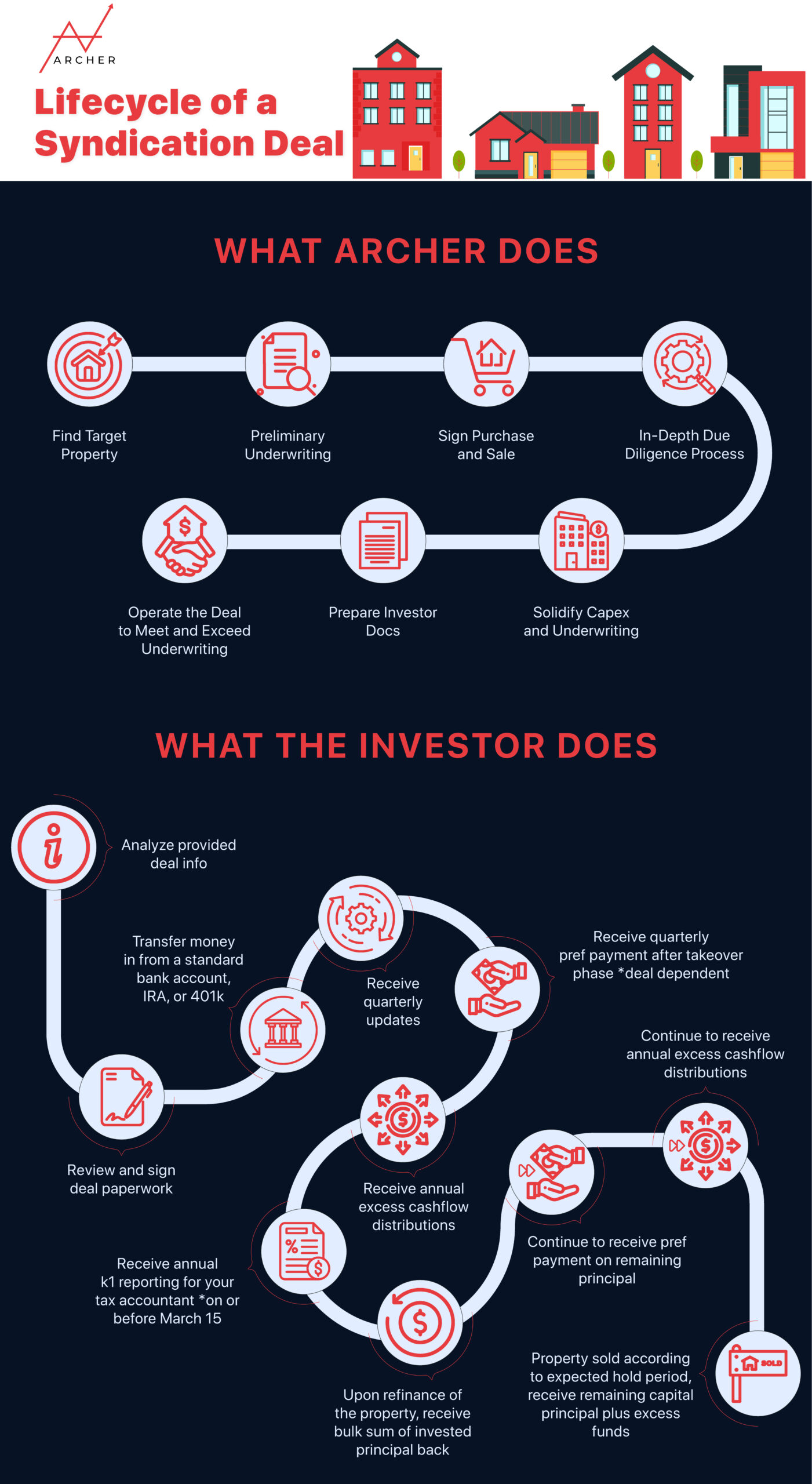

You are investing in a syndication. Syndication: Real estate syndication is a method through which multiple investors pool capital together to invest in larger real estate projects that would be difficult or impossible for an individual investor to undertake alone. In a real estate syndication, a sponsor, Archer Acquisitions, typically identifies and manages the investment opportunity, while other investors, you, (limited partners) contribute capital.

How long do I commit my money to this investment?

Investors can typically expect to commit their capital for 3 to 5 years before we refinance the asset, however, we typically hold the investment for a 7-10-year period. This period may vary based on several factors such as the execution of the business plan, external conditions (i.e interest rates, inflation, regulations, industry-specific factors, etc), etc. We as the sponsors will discuss projected timelines with all investors before the acquisition of the property and give regular updates, additionally, we will try to stay on track with our initial timeline and execute the strategy that creates the best returns for our investors.

What kind of return on investment can I expect?

Each RV park investment opportunity is different but we are motivated to hit a double-digit return, however, we never guarantee the return on investment. We discuss the business plan, projected returns, and equity structure with each investor for each investment opportunity. We target an 18-22% IRR (Internal Rate of Return) over the duration of the investment. The returns come from a mixture of forced appreciation, cash flow, and profits from the disposition (sale) or refinance of the property.

Each multi-family investment opportunity is different but we are motivated to hit a double-digit return, however, we never guarantee the return on investment. We discuss the business plan, projected returns, and equity structure with each investor for each investment opportunity. We target a 13%-18% IRR (Internal Rate of Return) over the duration of the investment. The returns come from a mixture of forced appreciation, cash flow, and profits from the disposition (sale) or refinance of the property.

How often are distributions sent?

Investors should expect distributions quarterly and excess cashflow distributions on an annual basis, however, this is subject to change based on the specific business plan for each opportunity as well as the performance of the property.

Can I request my initial investment back at any time?

No, all commercial real estate investments are long-term investments. Archer Acquisitions provides investors with projected timelines before the investor invests in the opportunity, and consistently throughout the life of the investment

Am I investing in individual projects or a fund?

Archer Acquisitions currently only offers investments in individual projects and not blind funds. This allows you to decide where your investment is going.

Can I invest using an SDIRA or 401k?

Yes, we can process investments via a variety of self-directed retirement accounts.

Will I need to file an extension for my personal tax return?

We stay ahead of the bookkeeping throughout the year to ensure that we can deliver timely tax documents to investors. We always try and issue Schedule K-1 forms to investors by March 15, so that investors do not need to file a personal tax extension, and have all the documentation needed to file by the typical filing date. This is almost always the case, and delivery of tax documents will be communicated clearly throughout the investment period.